Kickstart Your Journey to Better Credit Today!

Join our awesome members on their journey to credit greatness with CreditInsights!

Try it now

Your insights toolkit

Score Center

Track your credit score progress and set achievement goals for your journey.

24/7 Monitoring

Continuous credit monitoring with instant notifications of changes.

Score Tracking

Visual progress tracking showing your score improvements over time.

3-Bureau Reports

Comprehensive credit reports from all three major credit bureaus.

Dispute Hub

Challenge inaccuracies and track dispute progress with our automated system.

Smart Alerts

Real-time alerts for important changes to your credit report.

Success stories

Sign-Up Today

The plan that best fits your credit improvement journey

Pro Insights

Complete credit monitoring & protection

- 3-Bureau Report and Score

- Dispute System

- $1M Identity Theft Insurance

- Credit Score Monitoring

- Email Alerts

Credit Education

Insights and strategies to master your credit journey

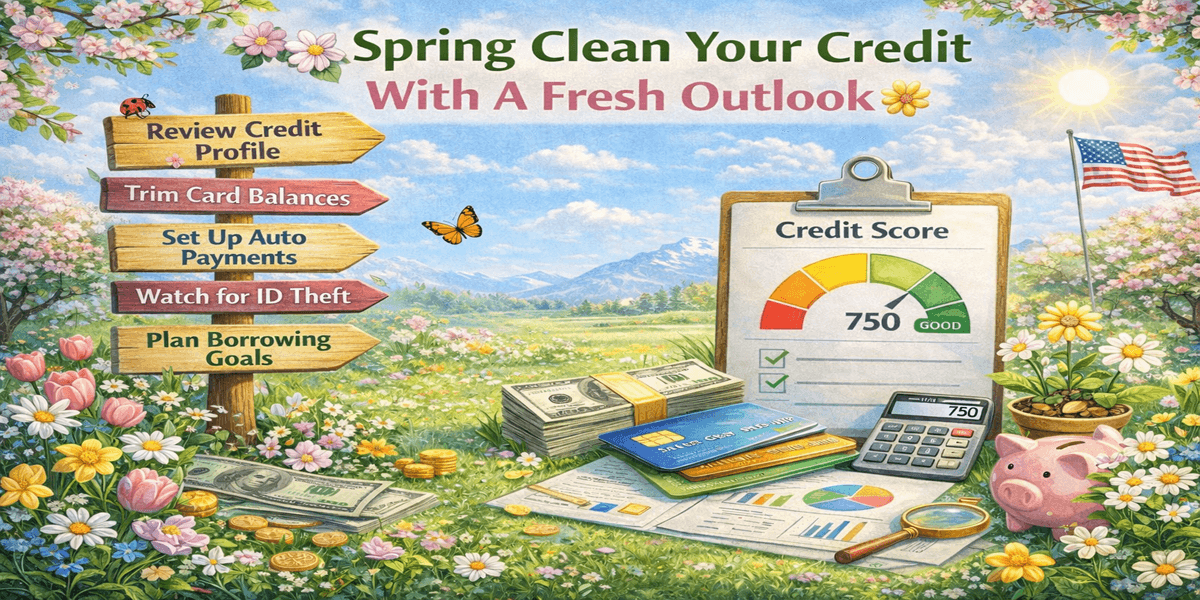

🌸Spring Clean Your Credit With A Fresh Outlook🌼

Spring is the season of renewal. We open the windows, clear out the clutter, and make space for something better. But while you’re organizing closets ...

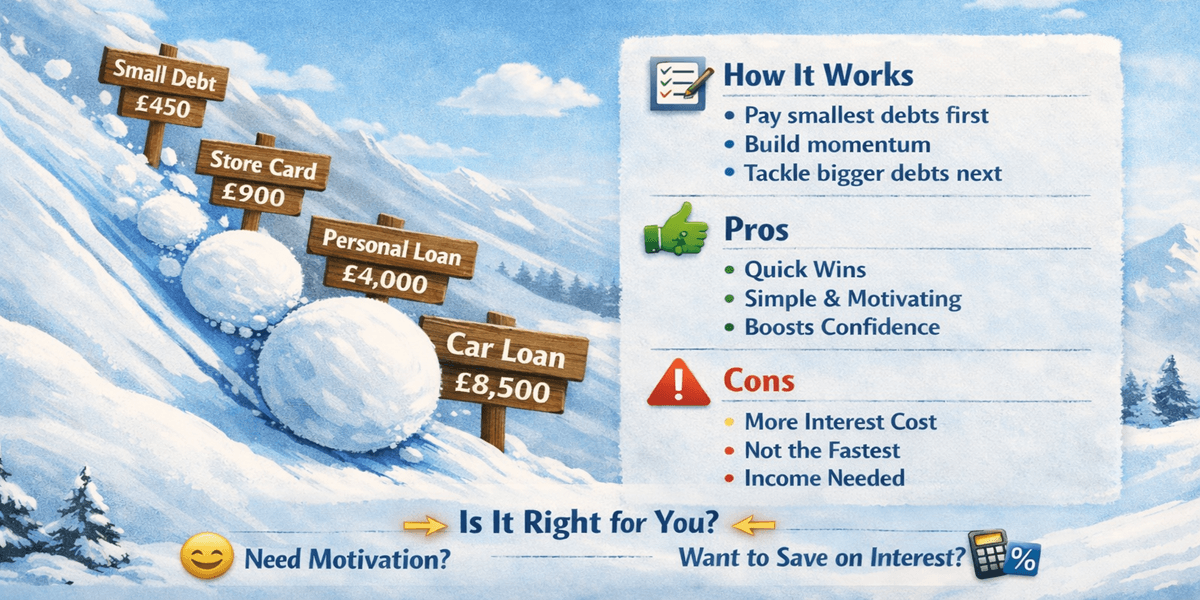

❄️The Debt Snowball Method: How It Works, Pros & Cons, and Whether It’s Right for You💳

Debt can feel overwhelming — especially when you’re juggling multiple balances, different interest rates, and minimum payments that barely seem to mak...

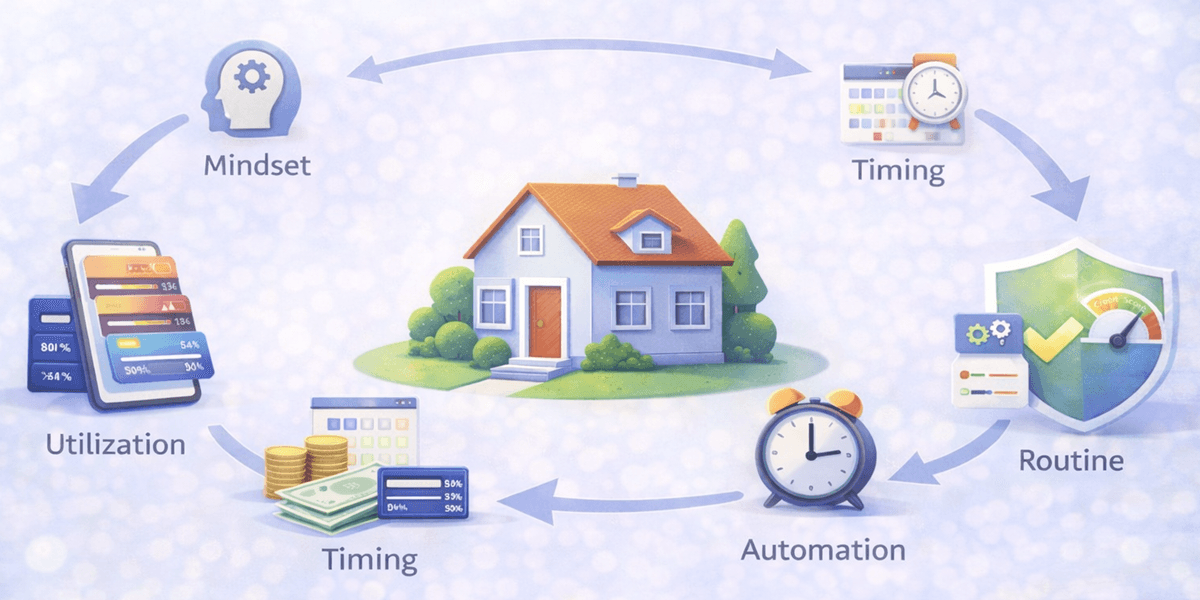

🏠Take Control of Your Home Economy — Bringing It All Together🔁

Over the past six blogs, we’ve broken credit management down into clear, practical parts.

🔁📘 Building a Credit Control Routine — A Simple Monthly System That Works

Most people don’t struggle with credit because they lack knowledge. They struggle because credit management is treated as something to think about onl...

🛠️Using Credit Offers and Loans Without Hurting Your Score🧩

Credit offers are everywhere. Pre-approved cards. Balance transfer promotions. Loan comparisons promising fast decisions and lower payments.

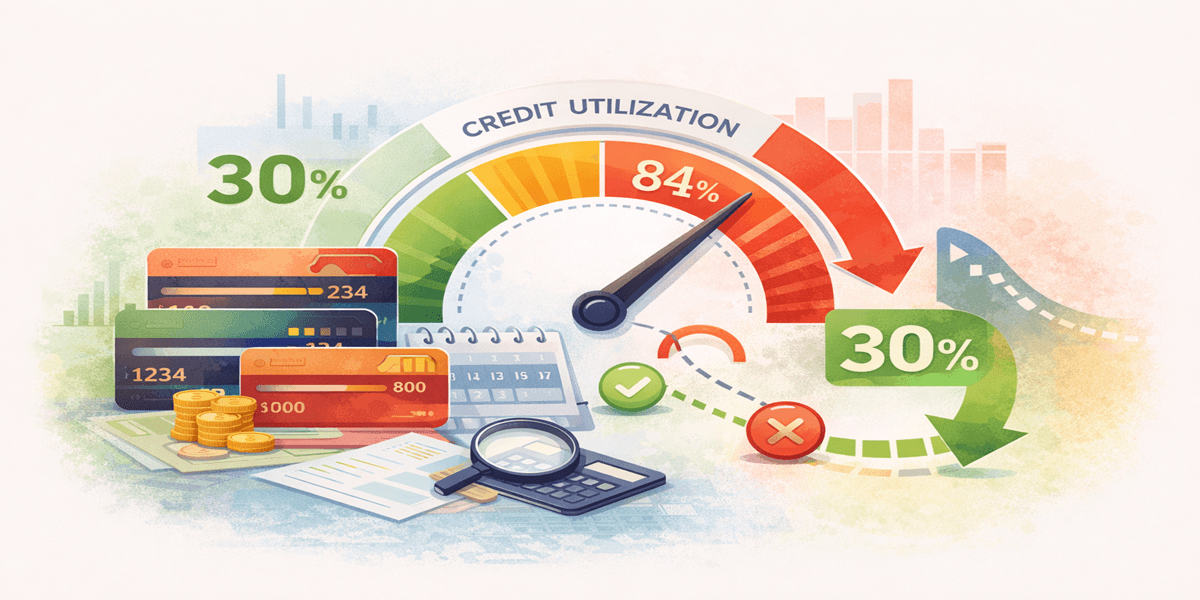

📊🔁 Mastering Credit Utilization — The Fastest Way to Regain Control

When people think about improving their credit, they often focus on the wrong levers: opening new accounts, chasing small score increases, or waiting ...