📊🔁 Mastering Credit Utilization — The Fastest Way to Regain Control

When people think about improving their credit, they often focus on the wrong levers: opening new accounts, chasing small score increases, or waiting for old issues to “age off.” But there is one factor that can shift credit outcomes faster than almost anything else — credit utilization.

Utilization isn’t complicated, but it is powerful. And when households understand how it works, it becomes one of the most effective tools for regaining control of both credit and cash flow.

📊 What Credit Utilization Really Means

Credit utilization is the percentage of available revolving credit you’re using at any given time.

If you have:

A credit card with a $1,000 limit

A balance of $300

Your utilization on that card is 30%.

Lenders don’t just look at your total balances. They look at:

Utilization per card

Utilization across all cards

How often balances approach limits

Whether balances are rising or falling

This makes utilization one of the clearest signals of short-term financial pressure.

⚡ Why Utilization Has Such a Big Impact

Utilization is weighted heavily because it answers a core lender question:

“How dependent is this household on borrowed money right now?”

High utilization suggests stress or limited flexibility. Lower utilization suggests control and margin.

Unlike payment history, which takes time to build or repair, utilization can change within a single billing cycle. That’s why it’s often the fastest way to influence credit outcomes.

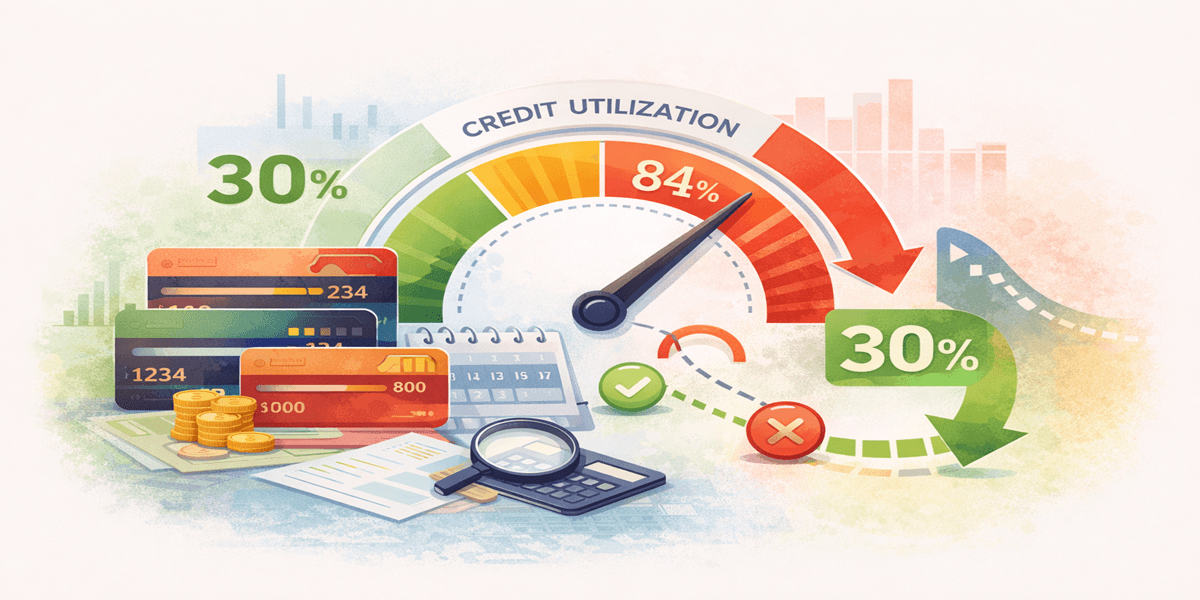

📉 The Utilization Thresholds That Matter

While scoring models vary, these ranges are broadly consistent:

0–9% → Excellent

10–29% → Very good

30–49% → Moderate risk

50–74% → High risk

75%+ → Very high risk

Crossing 30%, 50%, or 75% can trigger noticeable drops — even if you’ve never missed a payment.

Just as importantly, utilization is not averaged emotionally. One maxed-out card can weigh down an otherwise healthy profile.

🧠 The Most Common Utilization Mistakes

Many households unintentionally sabotage their credit by misunderstanding how utilization works.

❌ Mistake 1: “I pay in full every month, so it doesn’t matter”

If your balance is high when it’s reported, it still counts — even if you pay it off later.

❌ Mistake 2: Focusing only on total utilization

A single card at 90% utilization can hurt more than three cards at 20%.

❌ Mistake 3: Letting balances spike temporarily

Short-term spikes around holidays or emergencies can still be captured in reports.

❌ Mistake 4: Using all cards “a little”

Spreading balances across every card raises overall exposure and reduces flexibility.

🛠️ Tools That Help You Control Utilization

Utilization improves fastest when households use visibility tools, not willpower alone.

📄 Credit reports

These show:

Individual card limits

Reported balances

Which cards are driving utilization

📊 Utilization trackers

Dashboards that visualize utilization by card help households:

Identify problem accounts quickly

Prioritize which balances to pay first

Avoid accidental threshold crossings

🔔 Balance alerts

Simple alerts when a card crosses:

30%

50%

75%

…can prevent damage before it happens.

These tools turn utilization from a mystery into something manageable.

💡 The “One-Card Focus” Strategy

One of the most effective techniques is choosing one card to actively reduce, rather than trying to fix everything at once.

How it works:

Identify the card with the highest utilization

Redirect extra payments there

Keep other cards stable (not growing)

Once that card drops below 30%, move to the next

This approach:

Delivers faster visible results

Reduces mental overload

Improves credit signals incrementally

Momentum matters — psychologically and financially.

🗓️ Timing Matters More Than Amounts

Many people don’t realize that when you pay can matter as much as how much you pay.

Most cards report balances:

On the statement closing date

Not on the due date

That means:

Paying part of the balance before the statement closes can reduce reported utilization

Waiting until the due date may be too late for that cycle

Even partial early payments can significantly improve utilization signals.

🏠 Utilization and the Home Economy

Utilization isn’t just about credit scores — it reflects how a household is operating day to day.

High utilization often signals:

Income timing mismatches

Over-reliance on cards for essentials

Limited cash buffers

Reactive spending patterns

Lower utilization suggests:

Better cash flow alignment

More margin for emergencies

Greater financial confidence

Reduced stress

In this way, utilization becomes a home-economy health indicator, not just a credit metric.

🧠 Emotional Traps to Avoid

Utilization improvements can trigger emotional responses that undo progress.

⚠️ “My score went up — I can relax”

Early gains are fragile. Stability over time matters more than a single jump.

⚠️ “I should close unused cards”

Closing cards reduces available credit and can increase utilization overnight.

⚠️ “I’ll wait until I can pay it all off”

Small, strategic reductions often work better than waiting for perfection.

Progress beats delay.

🔁 How Utilization Fits Into the Bigger System

Utilization works best alongside:

Consistent on-time payments

Controlled application behavior

Credit monitoring for balance spikes

Budgeting that reflects real cash flow

It doesn’t require new debt, complex strategies, or financial gymnastics. It requires awareness, timing, and intention.

That’s why it’s often the first lever to pull when regaining control.

✅ Key Takeaway

📉 Credit utilization is the fastest, most controllable way to shift credit outcomes — because it reflects what’s happening right now.

You don’t need perfect finances to improve utilization. You need:

Visibility

A plan

The right tools

Consistent, small actions

Mastering utilization puts households back in the driver’s seat — and sets the foundation for everything that follows.