🏠Take Control of Your Home Economy — Bringing It All Together🔁

🏠Take Control of Your Home Economy — Bringing It All Together🔁

Over the past six blogs, we’ve broken credit management down into clear, practical parts.

Not hacks

Not quick fixes

Not score chasing.

Instead, we focused on something far more powerful:Building a system.

Because credit control doesn’t come from intensity. It comes from structure.

Let’s bring everything together.

🧠The Home Economy Mindset

Everything starts here.

Credit problems rarely begin with a single mistake. They begin when the home economy — the system connecting income, bills, credit usage, and risk — lacks visibility.

When there’s no clear structure:

Balances drift upward

Due dates cluster

Utilization spikes

Monitoring becomes reactive

The first shift isn’t financial. It’s mental.

You stop thinking: “Why did my score drop?”

And start thinking: “What changed in my system?”

That mindset shift changes everything.

🔔Monitoring Without the Stress

Monitoring isn’t about watching your score daily.

It’s about shortening the gap between:

A change happening

You becoming aware of it

High-value alerts protect you from:

Fraud

Reporting errors

Utilization spikes

Low-value alerts create noise. The goal is not obsession. It’s awareness.

Monitoring becomes the background safety net — not the main event.

📉Mastering Credit Utilization

If there’s one lever that moves quickly, it’s utilization.

We covered how:

Utilization is reported on statement dates

Per-card balances matter

Thresholds (30%, 50%, 75%) create shifts

Timing can influence reported balances

This is where many households regain control fastest.

Not by earning more

Not by opening accounts

But by managing what’s already in motion.

Utilization becomes a signal — not a mystery.

📆Cash Flow & Payment Timing

Late payments and high utilization often trace back to timing misalignment.

We explored:

Statement dates vs due dates

Aligning bills with income

Early payments before reporting

Smart auto pay setup

Most credit stress isn’t affordability stress. It’s timing stress.

When payment timing aligns with income, credit stabilizes naturally.

🔁Automation That Supports You

Automation isn’t about “set and forget.”

It’s about protecting your system from:

Busy weeks

Human error

Small oversights

The layered approach works best:

🛠️ Minimum autopay for safety

🔔 Balance alerts for awareness

📆 Statement tracking for optimisation

🧮 Calculators for clarity

Automation doesn’t replace discipline. It protects it.

🧩Using Credit Tools Without Hurting Yourself

Credit offers and loans aren’t the enemy. Misalignment is.

We broke down:

🔍 Soft vs hard checks

The reality of “pre-approval”

When consolidation helps — and when it doesn’t

How rate shopping works

Credit tools amplify whatever system they enter. If your home economy is stable, they support flexibility. If it’s unstable, they magnify risk.

The lesson isn’t to avoid credit. It is to use it deliberately. And carefully.

📘The Monthly Credit Control Routine

Everything above only works if it’s repeatable.

That’s why we built the 30-Minute Monthly Credit Check:

📉 Review balances & utilization

✅ Confirm payments posted

🔔 Scan alerts

🔁 Adjust one thing

🧠 Log a note

Consistency beats intensity.

A short routine prevents:

Emergency-only reactions

Emotional decision-making

Surprise declines

Credit becomes part of your system — not something that interrupts it.

🏗️ What This Series Really Built

This wasn’t a series about boosting your score by 20 points.

It was about building:

Visibility

Predictability

Structure

Confidence

When households implement systems instead of reacting emotionally, outcomes stabilize over time.

Operational environments show the same pattern — structured routines reduce error, improve efficiency, and prevent reactive work.The same principle applies to personal credit management. Systems outperform bursts of effort. Every time.

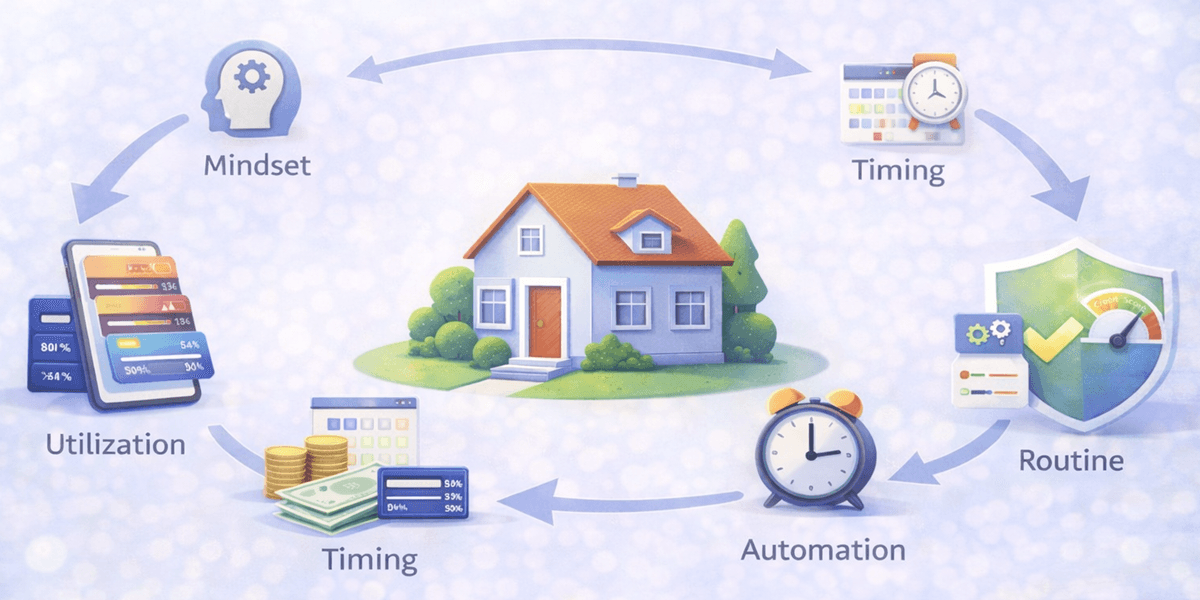

🏠 The Complete Credit Control Framework

When you zoom out, the system looks like this:

🧠 Mindset - Understand the home economy as a system.

🔔 Awareness - Monitor for meaningful changes.

📉 Control - Manage utilization intentionally.

📆 Timing - Align payments with reporting cycles.

🛠️ Automation - Protect your system from disruption.

🔁 Routine - Repeat consistently.

Each layer supports the next. Remove one, and the system weakens. Maintain all six, and control becomes predictable.

💡 What Changes When You Follow This System

Credit becomes:

Less emotional

Less surprising

Less reactive

More strategic

You stop asking: “What happened?”

And start asking: “What adjustment makes sense this month?”

That shift builds calm confidence.

⚠️ What This Series Is Not

It’s not:

A guarantee of approvals

A promise of instant score jumps

A strategy for gaming the system

It’s a structure for managing risk, timing, and visibility. And that’s far more sustainable.

✅ Final Takeaway

🔁 Credit control isn’t complicated — it’s just rarely organized.

You don’t need to monitor daily

You don’t need perfect discipline

You don’t need to avoid credit entirely.

You need:

A clear system

Repeatable actions

Measured decisions

Monthly visibility

When credit management becomes structured, it stops feeling stressful.

And when it stops feeling stressful, it becomes sustainable.