The Credit Score Blueprint: Understanding What Makes Your Number Rise and Fall

Your credit score isn't just a random number—it's a carefully calculated assessment of your financial reliability that can either open doors to opportunities or create costly barriers. Understanding the mechanics behind this three-digit number is essential for anyone looking to improve their financial standing in today's credit-driven economy.

What Really Goes Into Your Credit Score?

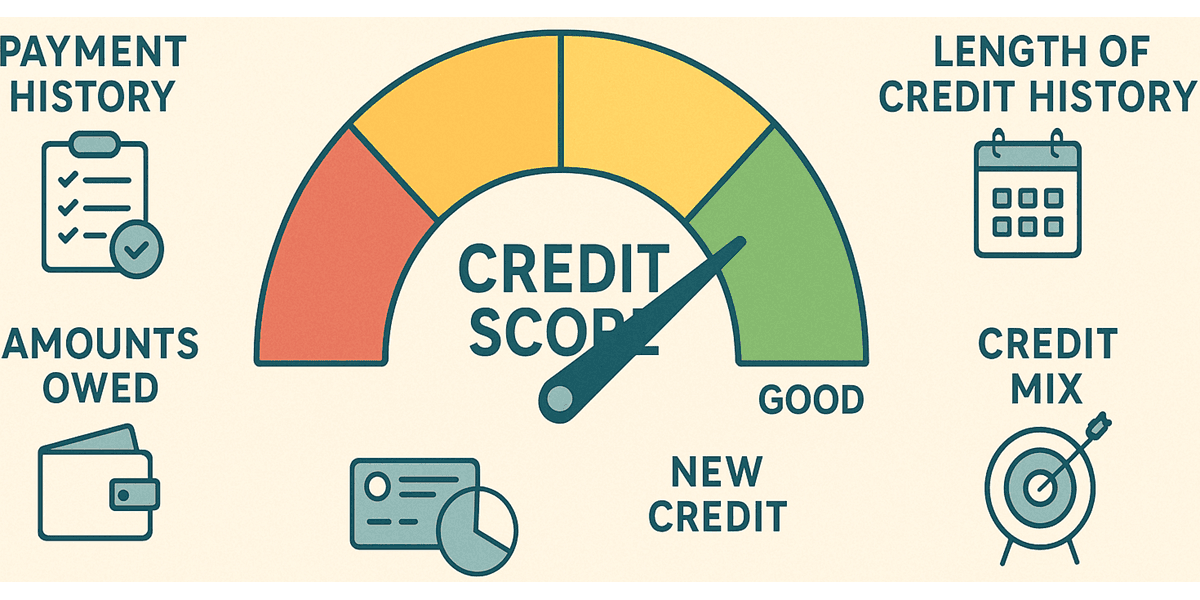

Your FICO score, the most widely used credit scoring model, breaks down into five key components that lenders analyze when considering your applications:

Payment History (35%): This represents the cornerstone of your credit score. Lenders want to know one thing above all else: "Does this person pay their bills on time?" Every payment you make—or miss—creates a paper trail that follows you for up to seven years. A single 30-day late payment can drop a good score by 50-100 points overnight.

Credit Utilization (30%): This ratio measures how much of your available credit you're currently using. Financial experts consistently recommend keeping this percentage below 30%, though those with exceptional credit often maintain it under 10%. For example, if you have $10,000 in available credit, keeping your balances below $3,000 demonstrates responsible credit management.

Length of Credit History (15%): Credit scoring models favor consumers with longer track records. This is calculated by averaging the age of all your accounts, with special emphasis on your oldest account and the average age of all accounts. This explains why closing old credit cards—even unused ones—can temporarily hurt your score.

Credit Mix (10%): Diversity in your credit portfolio shows you can handle different types of financial obligations. Having both revolving credit (like credit cards) and installment loans (like mortgages or auto loans) typically results in a higher score than having only one type.

New Credit (10%): Each time you apply for credit, a "hard inquiry" is recorded on your report, typically lowering your score by 5-10 points for up to a year. Multiple applications in a short period can signal financial distress to lenders.

Strategic Steps to Boost Your Score

Instead of vague advice about "paying bills on time," try these specific, actionable strategies:

Set up autopay with cushion dates: Configure automatic payments for 2-3 days before due dates to prevent technological glitches from causing late payments.

Practice the "AZEO" method: "All Zero Except One" means paying all credit cards to zero before statement closing dates, except for one card with a small balance (1-2% of its limit). This approach often produces higher scores than having zero balances on all cards.

Request goodwill adjustments: If you have an otherwise excellent payment history but slipped once, write a goodwill letter to your creditor requesting removal of the late payment from your report. Success rates vary, but approximately 30% of consumers see positive results.

Strategically time credit applications: Before applying for a major loan like a mortgage, avoid any new credit applications for at least six months to maximize your score.

Consider a secured credit builder loan: These specialized products, offered by credit unions and online lenders, allow you to essentially borrow from yourself while building positive payment history.

Understanding Score Fluctuations

Your credit score isn't static—it changes constantly as new information is reported. Month-to-month variations of 20-30 points are normal and typically result from:

• Reporting cycles: Different creditors report to bureaus on different schedules throughout the month

• Balance changes: As your reported credit card balances change, so does your utilization ratio

• Age factors: As your accounts age, the average age of your credit history gradually increases

• Hard inquiries aging: As inquiries get older, their negative impact diminishes

The Real-World Impact of Score Improvements

Moving from a "fair" (580-669) to "good" (670-739) credit score category can translate to remarkable financial benefits:

• On a $300,000, 30-year mortgage, the interest savings could exceed $72,000 over the loan's lifetime

• Auto insurance premiums may decrease by 20-50%

• Credit card approval odds increase dramatically, along with access to premium rewards programs

• Security deposit requirements for utilities and rentals are often reduced or waived entirely

Understanding and actively managing your credit score isn't just about numbers—it's about creating tangible financial advantages that compound over time. By implementing these strategies consistently, you're not just improving a score; you're expanding your financial opportunities and reducing the cost of borrowing for years to come.