📆🔁 Payment Timing & Automation — Turning Good Intentions Into Consistent Credit Results

Many households do the “right things” with credit. They pay their bills on time, avoid missed payments, and try to stay within their means — yet still experience frustrating credit outcomes.

Balances feel stubborn. Scores fluctuate unexpectedly. Credit utilization seems higher than expected.

In most cases, the problem isn’t effort. It’s timing.

Payment timing and automation are often overlooked because they don’t feel dramatic. But they quietly shape how credit activity is reported, interpreted, and evaluated. When these systems are working properly, credit outcomes improve almost invisibly. When they’re misaligned, even responsible behavior can produce disappointing results.

This follow-up to Blog #4 focuses on how payment timing and automation turn good intentions into reliable, repeatable outcomes.

🧠 Why Payment Timing Matters More Than Most People Realize

Most people are taught a single rule about credit cards:

“Pay your bill by the due date.”

That rule protects you from late payments — but it doesn’t explain how credit actually gets reported.

Credit scoring and lender reviews are driven by snapshots, not narratives. They don’t see how hard you tried or how quickly you paid something off later. They see what was reported at a specific moment in time.

That moment is usually tied to the statement closing date, not the due date.

Understanding this distinction is one of the most important shifts a household can make.

📄 Statement Closing Date vs ⏰ Payment Due Date

Every credit card cycle revolves around two key dates, and confusing them is one of the most common sources of frustration.

📄 Statement Closing Date

This is the date when:

Your balance is finalized for the billing cycle

That balance is typically reported to the credit bureaus

Credit utilization is calculated for that month

Think of this as the camera snapshot date.

⏰ Payment Due Date

This is the date by which:

You must make at least the minimum payment

You avoid late fees and late payment reporting

Think of this as the deadline, not the snapshot.

If a balance is high on the statement date, that’s what usually gets reported — even if you pay the balance in full a week later.

This is why someone can pay on time every month and still struggle with utilization-related issues.

📉 How Payment Timing Directly Affects Utilization

Credit utilization is calculated using the balance that appears on your statement relative to your credit limit.

That means:

Utilization is reported, not averaged

Temporary spikes can still be captured

Early payments can materially change outcomes

A simple example

Credit limit: $2,000

Balance before statement closes: $1,200 (60% utilization)

Early payment before statement: $500

Reported balance: $700 (35% utilization)

Nothing about spending changed. Only timing did.

This is why payment timing is one of the fastest levers available for regaining control.

🔁 Automation: Protecting Outcomes From Busy Life

Even when people understand timing, life still gets in the way.

Automation exists to protect outcomes when:

Schedules get hectic

Attention shifts elsewhere

A month is tighter than expected

The goal of automation is not to remove awareness — it’s to remove fragility from the system.

Good automation ensures that one busy week doesn’t undo months of progress.

🛠️ Building a Smart Automation Stack (Layer by Layer)

Automation works best when it’s layered intentionally, not applied all at once.

🛠️ Layer 1: Minimum Payment Autopay (The Safety Net)

Setting autopay for the minimum payment:

Protects your payment history

Prevents accidental late payments

Reduces stress during tight months

This is not about paying the bare minimum forever. It’s about ensuring that payment history remains intact even if something unexpected happens.

Think of this as insurance, not a strategy.

🔔 Layer 2: Balance & Threshold Alerts (Early Awareness)

Automation alone isn’t enough if you’re flying blind.

Balance alerts help households notice:

When a card crosses 30% utilization

When balances rise faster than expected

When spending patterns drift

These alerts don’t force action — they prompt intentional review before damage occurs.

This is where automation supports awareness instead of replacing it.

📆 Layer 3: Statement Date Tracking (The Optimization Layer)

Knowing statement dates allows households to:

Make small early payments strategically

Control which balances are reported

Avoid utilization spikes without drastic changes

Many people know their due dates but have no idea when statements close. Once statement dates are visible, utilization becomes predictable rather than mysterious.

This is often the turning point where credit starts to feel manageable instead of confusing.

🧮 Layer 4: Payment Impact & Scenario Tools

One of the biggest barriers to action is uncertainty:

“How much do I need to pay?”

“Will this actually make a difference?”

“Is it worth moving money now?”

Payment impact tools answer those questions before money moves.

They:

Show how much to pay to cross a utilization threshold

Clarify whether timing alone is sufficient

Reduce emotional decision-making

Confidence grows when outcomes are visible in advance.

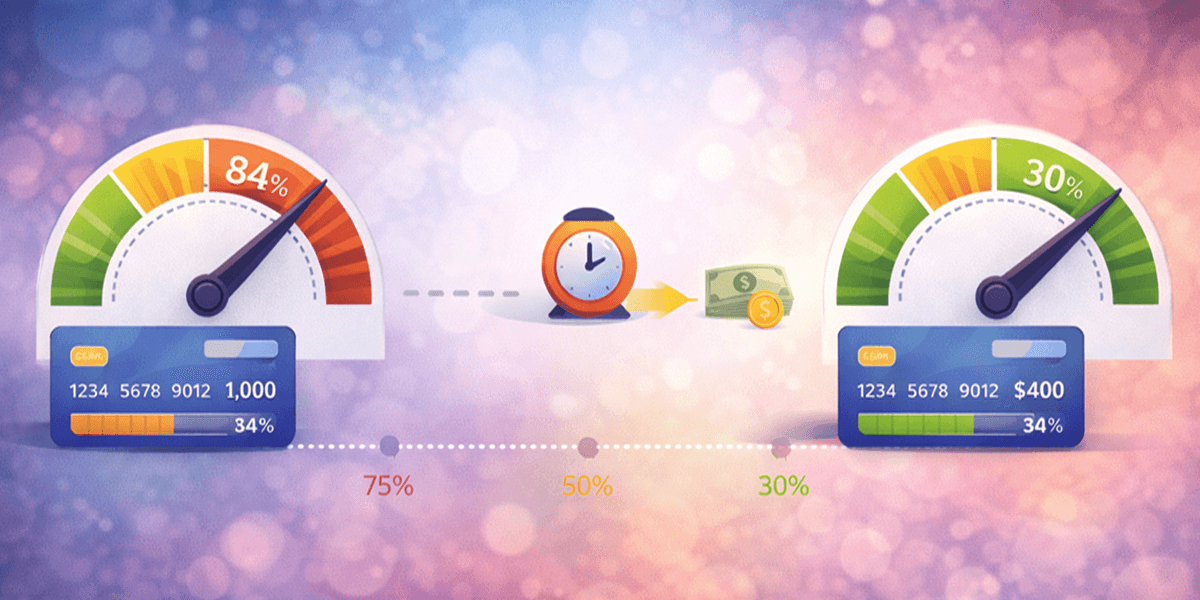

📊 Understanding the Utilization Explainer Graphic

The utilization explainer graphic introduced in this series is intentionally text-free. Its purpose is not to teach rules, but to show cause and effect visually.

What the graphic communicates

A utilization gauge moving from red → yellow → green

A timeline showing balance before and after statement close

Clear visual separation between “reported” and “paid later”

Why this matters

Many consumers intellectually understand utilization but don’t feel it. Visuals compress complexity into something intuitive, helping households internalize why timing matters without needing formulas.

This visual clarity often reduces anxiety more effectively than explanations alone.

⚠️ Common Automation & Timing Pitfalls

Even well-intentioned systems can backfire if they’re misunderstood.

❌ Full-Balance Autopay Without Cash-Flow Awareness

This can strain checking accounts and increase reliance on credit elsewhere.

❌ No Alerts Enabled

Without alerts, automation becomes passive rather than protective.

❌ Ignoring Statement Dates

This turns utilization into guesswork and creates avoidable frustration.

Automation should support control, not hide problems.

🏠 Payment Timing Inside the Home Economy

Payment timing doesn’t exist in isolation. It interacts with:

Income schedules

Household buffers

Credit card usage patterns

Monthly variability

When timing aligns with the broader home economy:

Credit outcomes stabilize

Stress decreases

Decisions feel deliberate

Progress becomes repeatable

This is why payment timing sits at the center of sustainable credit management — it connects behavior, systems, and outcomes.

🔁 A Simple Monthly Timing Check (Under 5 Minutes)

Once per month:

Review upcoming statement dates

Check current utilization levels

Confirm alerts are active

Adjust one payment if needed

Small, consistent adjustments prevent large, stressful corrections later.

✅ Key Takeaway

🔁 Payment timing and automation don’t change how responsible you are — they change how reliably that responsibility shows up on your credit.

You don’t need perfection, new credit, or complicated strategies. You need:

Visibility into key dates

Automation that protects you

Tools that replace guesswork

When timing and automation work together, credit control becomes routine — not reactive.