🔄Credit Utilization Matters More Than You Think — How to Use Credit Without Hurting Your Score📈

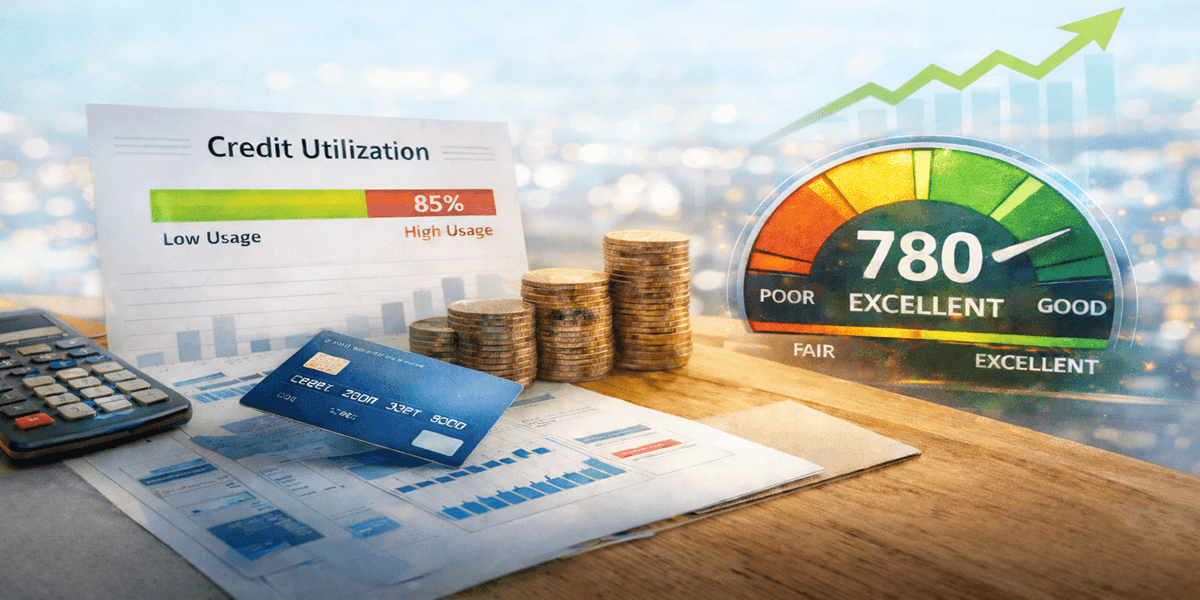

After understanding your credit footprint, simplifying your credit activity, and committing to long-term habits, the next critical concept to master is credit utilization. For many consumers, utilization is one of the most confusing—and frustrating—factors affecting their credit score.

You can pay every bill on time and still see your score fluctuate. The reason often comes down to how much credit you’re using at the moment your lender reports your balance.

What Credit Utilization Actually Measures

Credit utilization is the ratio between your current balances and your available revolving credit, typically credit cards. It is calculated both:

On each individual card, and

Across all revolving accounts combined

For example, a $2,500 balance on a $10,000 limit card equals 25% utilization. If your total limits across all cards are $30,000 and your combined balances are $6,000, your overall utilization is 20%.

Both numbers matter.

Credit scoring models evaluate utilization as an indicator of current credit risk, not long-term reliability. While payment history shows whether you can repay debt, utilization shows how close you are to your limits right now.

Why Utilization Has Such a Strong Impact

Utilization carries significant weight because it reflects short-term behavior. A consumer who is consistently near their credit limits may appear financially stretched, even if payments are made on time.

This explains why:

Scores can drop suddenly after a period of heavy spending

Paying off balances doesn’t always result in an immediate score increase

One high-balance card can affect your score more than expected

Importantly, utilization is dynamic. Unlike late payments, which can remain on a credit file for years, utilization resets each reporting cycle.

The Statement Date Misunderstanding

One of the most common misconceptions is that paying your balance in full means utilization doesn’t matter.

In reality, most lenders report balances at the statement closing date, not the payment due date. This means:

A card can show high utilization even if it’s paid off days later

Scores may drop temporarily despite responsible repayment

Timing matters just as much as amounts

Understanding this reporting cycle allows consumers to manage utilization proactively rather than reactively.

What Utilization Levels Are Considered Healthy

There is no official threshold published by regulators, but general guidance used across the industry is:

Below 30%: Generally acceptable

Below 10%: Strong signal of responsible use

Below 5%: Often associated with top-tier scores

It’s also important to note that individual card utilization can matter as much as overall utilization. One maxed-out card can negatively impact a score even if your total usage is low.

Strategic Ways to Manage Utilization

Responsible utilization management does not require avoiding credit altogether. Instead, it involves:

Making payments before statement closing dates

Spreading balances across cards rather than concentrating them

Keeping older cards open to maintain available credit

Avoiding sharp month-to-month balance swings

Requesting credit limit increases can help lower utilization, but should only be done when income and stability support it, as some requests may involve a hard inquiry.

Why Utilization Is a Powerful Credit Tool

Because utilization updates monthly, it is one of the fastest levers consumers can use to influence their credit score—without opening or closing accounts.

Managed well, utilization allows your credit file to reflect balance, discipline, and control.

Key Takeaway

Credit utilization isn’t about how much debt you carry overall. It’s about how your credit use appears at specific moments in time. By managing timing and balances thoughtfully, consumers can use credit actively without undermining their score.