🔔📄 Credit Monitoring Without the Stress — What to Watch and What to Ignore?

Credit monitoring tools are becoming more popular and accessible. Score updates, alerts, identity warnings, and notifications all promise protection and control. But without context, these tools can easily create anxiety instead of clarity.

The goal of credit monitoring isn’t constant checking. It’s early awareness — knowing about changes early enough to respond calmly and effectively.

When monitoring is used correctly, it supports better decisions. When it’s misunderstood, it can feel overwhelming or misleading. Understanding the difference is what turns monitoring into a strength rather than a stressor.

🔔 What Credit Monitoring Is Actually For

Credit monitoring exists to shorten the gap between something changing and you finding out.

Used well, monitoring helps households:

Detect new accounts early

Catch balance spikes before damage spreads

Spot reporting errors quickly

Respond before problems compound

Monitoring is not designed to:

Predict loan approvals

Guarantee outcomes

Replace credit understanding

Eliminate all financial risk

Think of monitoring as awareness support — not a crystal ball.

📄 What Lenders Actually See (and What They Don’t)

One reason monitoring causes stress is confusion about who sees what.

📄 Credit reports show:

Account status (open, closed, delinquent)

Payment history patterns

Balances and credit limits

Account age and mix

Recent hard inquiries

These elements reflect patterns over time, not single moments.

🚫 Credit reports do not show:

Daily score fluctuations

Monitoring alerts

Weekly score trends

Personal circumstances or intent

Lenders never see your alerts. They never see how often you check your credit. They only see what is officially reported.

Understanding this distinction helps consumers focus on signals, not noise.

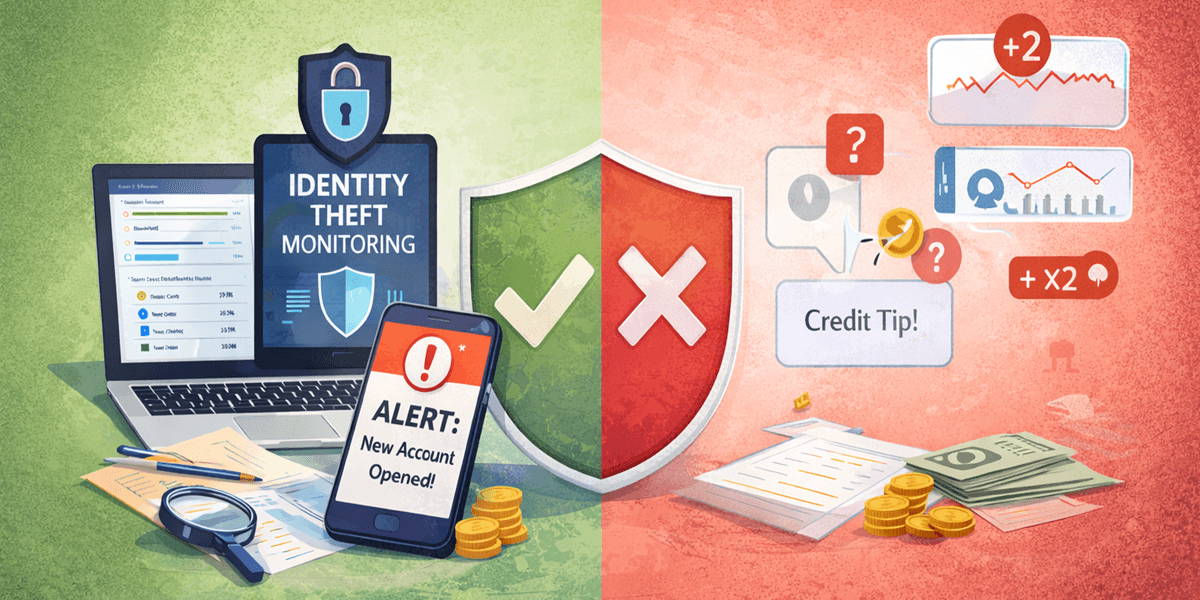

🔔 Alerts That Matter Most (High-Value Signals)

Not all alerts deserve equal attention. Some are early warnings worth acting on quickly.

✅ High-value alerts include:

New account opened Signals possible fraud or mistaken identity.

Payment marked late Requires immediate review to limit damage.

Balance jumps close to limits Indicates rising utilization risk.

Identity-related warnings Suggest compromised personal information.

These alerts protect credit by shortening reaction time.

🔕 Alerts That Matter Less (Low-Value Noise)

Some alerts exist to keep users engaged rather than informed.

⚠️ Lower-value alerts include:

Small score changes (up or down a few points)

Weekly or daily “score trend” notifications

Generic tips triggered automatically

“Congratulations” or “warning” messages without context

These alerts often reflect normal fluctuations, not meaningful change.

Ignoring them is not neglect — it’s focus.

🧠 Monitoring Without Obsession

Healthy credit monitoring follows a rhythm, not a constant feed.

🔁 A calmer, more effective approach:

🔔 Alerts ON for critical changes

📄 Credit report reviewed monthly

📘 Full review quarterly or annually

✅ Action taken only when needed

This approach keeps awareness high without turning monitoring into a source of anxiety.

Monitoring works best when it supports decisions — not emotions.

📄 Why Reports Matter More Than Scores

Scores are summaries. Reports are evidence.

Credit reports show:

Whether payments posted correctly

Which accounts influence utilization most

Where balances are trending

Whether data is accurate

A household can have:

A stable score with hidden risk, or

A fluctuating score with improving fundamentals

Reports provide context that scores alone never can.

🛡️ Identity & Dark Web Monitoring Explained Simply

Identity monitoring tools don’t prevent fraud. They reduce detection time.

That difference matters.

Early detection helps:

Limit financial damage

Shorten resolution time

Reduce stress and uncertainty

Protect long-term credit health

When used correctly, these tools act like background security — quiet, passive, and ready if needed.

They are defensive tools, not danger alarms.

🔔 How Monitoring Fits Into the Home Economy System

Monitoring supports the broader home economy by:

Increasing visibility

Reducing surprises

Supporting proactive action

Reinforcing confidence

It doesn’t replace:

Cash-flow management

Utilization control

Payment timing

Financial planning

Monitoring is one layer in a system — not the system itself.

🧠 The Monitoring Mindset

The healthiest way to think about credit monitoring is to compare it to a smoke detector.

You don’t stare at it all day

You want it to work instantly when needed

You take action only when there’s a real signal

Used this way, monitoring fades into the background — which is exactly where it belongs.

✅ Key Takeaway

🔔 Credit monitoring isn’t about watching everything — it’s about noticing the right things early.

With effective monitoring in place, households are free to focus on the most powerful controllable factor in credit outcomes: 📉 credit utilization and balance timing.

That’s where the next part of the series goes deeper.

YourCreditInsights can help you with the tools you need to take more effective control of your finances.

🔔 Credit alerts → New account & balance change notifications

📄 Credit reports → Full account & history view

🛡️ Identity tools → Dark web & breach monitoring

📘 Education prompts → Contextual explanations